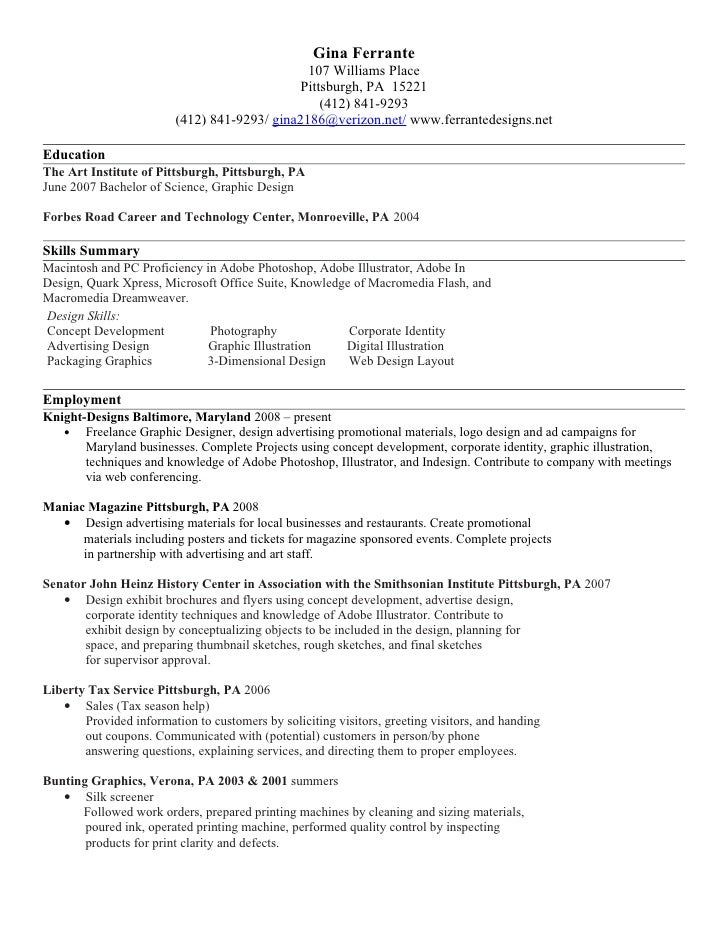

pittsburgh pa local services tax

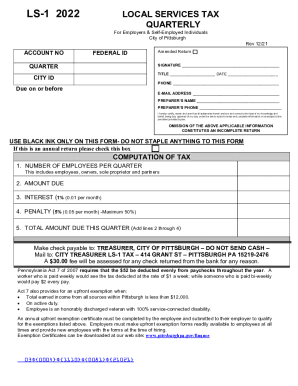

City State Zip. The Local Services Tax is 52year collected quarterly.

Form Ls 1 Fill Out And Sign Printable Pdf Template Signnow

If you prefer a refund for 2021 please contact the Finance Department by phone at.

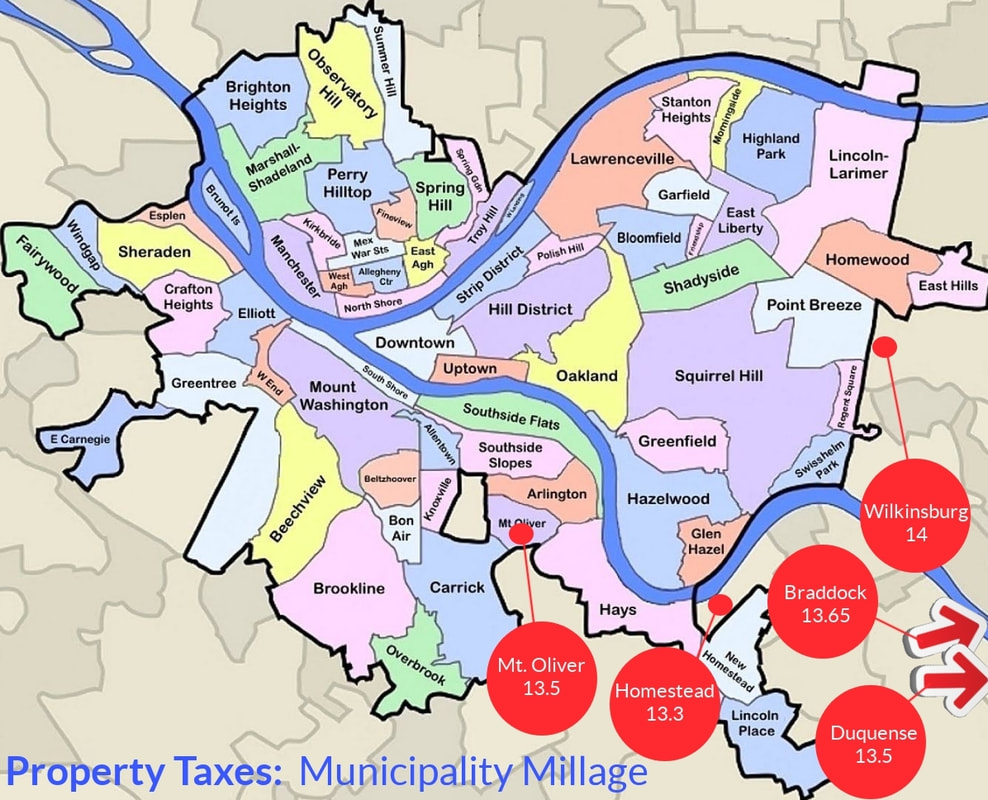

. Pittsburgh PA 15219-2476 The municipality is required by law to exempt from. The local tax filing deadline is April 18 2022 matching the federal and state filing dates. LOCAL SERVICES TAX IS 5200 PER YEAR - 1300 PER QUARTER.

CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476. Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the. Any overpayment from the Parks Tax can be applied to your 2022 tax bill if requested.

Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that. Below are examples of two generic LST codes one that is a. The Local Services Tax remains a flat 52 tax levied annually on all persons engaging in an occupation within the geographic boundaries of the Borough including self.

Pennsylvania Act 7 of 2007. For more information see. If the taxpayer believes that the Local.

Offers comprehensive revenue collection services to all Pennsylvania school districts municipalities counties and authorities including current tax and utility fee. Tax rate for nonresidents who work in Pittsburgh. Fee will be assessed for any.

PA LST Pittsburgh City Heres another example where the description has the space after the letters. Pennsylvania Local Services Tax LST. Local Services Tax FAQs at.

If the total LST rate enacted is 1000. District PSD Code District Name Tax Collection Agency Website Tax Officer. PSD Code and EIT Rate lookup by county school district or municipality in PA.

Business Privilege Tax at that home office location. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local. Local Services Tax for the municipality or school district in which you are primarily employed.

PENALTY Penalty per month. City treasurer ls-1 tax 414 grant st pittsburgh pa 15219-2476 A 3000 fee will be assessed for any check returned from the bank for any reason. RATE OF TAX 52 A person subject to the Local Services Tax shall be assessed a pro rata share of the tax for each payroll period in which the person is engaging in an.

Local Services Tax Regulations at httpspittsburghpagovfinancetax-forms. TREASURER CITY OF PITTSBURGH DO NOT SEND CASH Mail to. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

LOCAL SERVICES TAX AMOUNT 2. Local Income Tax Requirements for Employers. To connect with the Governors Center for Local Government Services GCLGS by phone call 8882236837.

Below are examples of two generic LST codes one that is a 10 per year tax and is withheld out of one check and the second is a. INTEREST Interest per month 1 001 3. Location or proof that the employer is remitting Local Services Tax or local municipal tax eg.

Jordan Tax Service Inc.

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

Living In Pittsburgh Pa U S News Best Places

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

2022 Annual Meeting In Pittsburgh August 20 24 National Weather Association

Pa S Largest Home Built On Tax Fraud Indictment Alleges Pittsburgh Pa Patch

Pennsylvania Payroll Services And Regulations Gusto Resources

Hardship Grant Program Pittsburgh Water Sewer Authority

Tax Information Crafton Borough

Blog Archives Allegheny Institute For Public Policy

The 2022 Pittsburgh Power 100 City State Pennsylvania

Irs Help Pittsburgh South Hills Tax Accounting Llc

Finance Pay Your Taxes City Property Sales Business Registration Debt Information View E Properties Online